After spending a month in the Chicago and spending majority of my savings on hotels, food, and a little entertainment and not able to find a place to live in enough time while working for $13/hr, I have come back to the Seattle area. Renting a room and working saving for a place here. Initially want to at least have 3 months worth of current rent saved up in a savings account before considering the next step. Included with that as well will be 3 months of expenses, fixed and variable. Going to wait till October to see where that’s at, having 20% of my paycheck being sent to my Barclay’s savings account. Waiting till October should be able to allow it to build with the percent contribution plus the 1.15% interest.

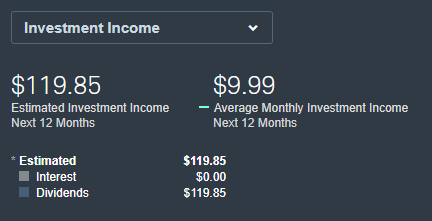

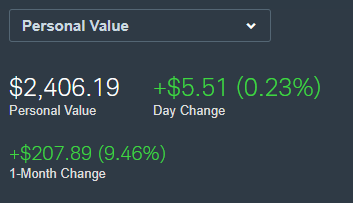

In the meantime, I will add to my Schwab brokerage, especially now that they offer a form of fractional shares. How I found out it works is that $5 is the minimum to buy a slice of a particular company that is qualified for the fractional share program that they offer. Allowed is the ability to select up to 10 at a time, making the minimum $50, maxing out at about $7,000. Needless to say, I just have 10 stocks that I used $50 to buy. Once I buy all on the table that I set up to guide me, than create a share quantity baseline to help me have a goal and to start building my account by adding more like bonds, treasuries, and CD’s with Schwab and/or Capital One bank since that with Capital One’s CD’s don’t require a minimum and would make it easier to pay off my credit card when I use it.