Hey there, fellow shoppers and crypto enthusiasts!

If you’re like me, you love finding ways to save a little extra while shopping online. Whether it’s grabbing your morning coffee at Starbucks, picking up essentials at CVS, or treating yourself to something special from your favorite store, it always feels good to get a bit more for your money. But what if I told you that you could not only save but also earn free bitcoin while doing your everyday shopping? That’s exactly what I’ve been doing with Lolli, and today, I’m here to share my experience.

What Is Lolli?

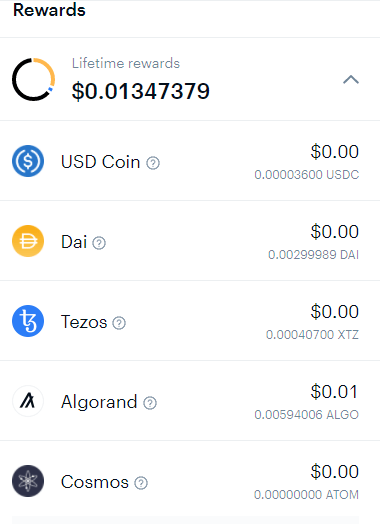

Lolli is a rewards platform that lets you earn bitcoin or cash back when you shop at over 25,000 stores, both online and in-store. It’s super easy to use, and you don’t need to be a crypto expert to get started. Whether you’re buying groceries, grabbing a coffee, or shopping for clothes, you can earn up to 30% back in bitcoin. And the best part? It’s completely free to use!

How Does It Work?

Once you’ve signed up for Lolli, you can add their browser extension, which will notify you when you’re shopping at a store that offers rewards. Simply activate the offer, shop as you normally would, and voila—you’ll earn a percentage of your purchase back in bitcoin. If you prefer shopping on your phone, Lolli also has an app that makes it easy to earn rewards on the go.

My Experience So Far

I’ve been using Lolli for a few months now, and I have to say, I’m impressed. I initially started using it at CVS for my regular health and beauty purchases, and it quickly became a habit. Then, I started exploring other participating stores, like Starbucks, where I get my daily caffeine fix. Seeing those small amounts of bitcoin add up in my Lolli wallet has been pretty satisfying.

One thing I appreciate about Lolli is that it doesn’t interfere with my shopping experience. The notifications are subtle, and activating the offers takes just a click. It’s also great to see how many major retailers participate in the program—there’s something for everyone!

Why You Should Try Lolli

If you’re someone who likes to shop online and you’re interested in exploring cryptocurrency, Lolli is a no-brainer. It’s a simple, risk-free way to dip your toes into the world of bitcoin while doing something you already do—shopping! Plus, if you’re not into bitcoin, you can always choose to cash out your rewards as regular cash.

Get Started Today and Earn $5 Free!

If you’re ready to start earning free bitcoin (or cash), I’ve got some good news! When you sign up for Lolli using this link and make your first purchase, both you and I will get $5 in free bitcoin or cash. It’s a win-win!

So why wait? Give Lolli a try and start turning your everyday purchases into bitcoin rewards. Happy shopping!

Disclaimer: The link provided is a referral link, meaning I may receive rewards if you use it to sign up. However, I only recommend products and services I truly believe in and have personally used.