Autumn Colors

Life is what it is, until it isn't. Hope to bring when it isn't on the occasion that it isn't.

“The comic and the tragic lie inseparably close, like light and shadow.” ~ Socrates

Comic and tragic, light and shadow, day and night, life and death. Yin Yang and two sides of any coin, for one to exist, so must the other. Tragedy of life, joy of death. Pain during life which is survival, surviving sickness and disease. One such disease is cancer. A slow take on what we try to avoid, forcing us to see into the abyss of what is inevitable, an eternal end or the beginning of something bigger.

“Death smiles at us all; all a man can do is smile back.” ~ Marcus Aurelius

When facing death directly in the face, knowing the time instead of trying to guess how much longer we have, how do we wrestle with our fate? A destiny so sure when cancers have their way, war comes our way, or when escape is surely out of reach. Acceptance is forced upon us, making us question our life’s path, having us question whether we’re at the value of our life instead of the quantity of years. How do we obtain value and quality in any amount of time given us, to where we’re able to give value to the life we live affect those around us.

My mom’s cancer, giving her a shorter life than what may have been originally promised. Her energy sapped, weight taken. Pain has taken the place of everyday life, giving her a persistent cough and organs that give pain. Death lurks, showing it’s face, especially to us who’ve become accustomed to it’s stench. How is death allowed when life is more precious than it?

Science still has yet to take this detriment from us. In the line of life, science is still young, still finding it’s place. How much longer will it’s path take to figure out what it is that is a foundation? Dealing with the certain, we become uncertain, hoping for more and creating myths and legends so as to better deal with our lot in life.

Cancer, for as long as it’s been around, studied, and progress made, how do we still not know it’s kind?

I ended up missing my appointment for the passport with photo. Overslept and had to work. My last day of my current job is Saturday coming up and move to Chicago will be a month after at least, depending on living and work to get situated there.

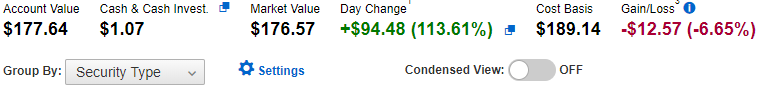

Ended up having to revamp my Robinhood account so that I can have the minimum at $1544 with dividend re-investment automated. Going to split it 54% stocks, 44% bonds (ETF: BND), 2% Cash. This hopefully gets me interest plus the DRIP, hopefully to increase at a desired rate during the six months before going Zambia. The six months will be for making my passport valid before traveling internationally.

My mom has cancer and has about 5 -6 months. I’m in a funk about it, depressed and hoping that it’ll be better than thought. The reality though is much different. For me, the move back to Chicago would be for a better job which would allow for a trip when the inevitable happens. The budget plan allows for trip and allowance when it happens.

Passport came back. Thought there had been sent to renew in enough time but considering the current situation with the pandemic, it appears to have been sent with not enough time for it to be renewed by mail. Now, the situation is that I have to start a whole new passport. It’s just a matter of setting an appointment. Wasn’t able to make an appointment thru the phone, so attempted thru online. Being able to do that though is like pulling teeth. Not sure why it’s so difficult because it’s hardly allowing usable links or options to create the appointment. May have to check back tomorrow for making an appointment for Friday. Since I get off at 2:30 pm tomorrow, I may have to physically go there in person, especially to see about the $149 money order that I originally intended to pay for the mail-in renewal but got sent back with the old passport that never got processed.

Hoping that it doesn’t become too much of a hassle, would at least like to plan an international trip when the pandemic becomes under control. Though, as more people become vaccinated and places start opening up more, it should allow for more in-person capabilities.

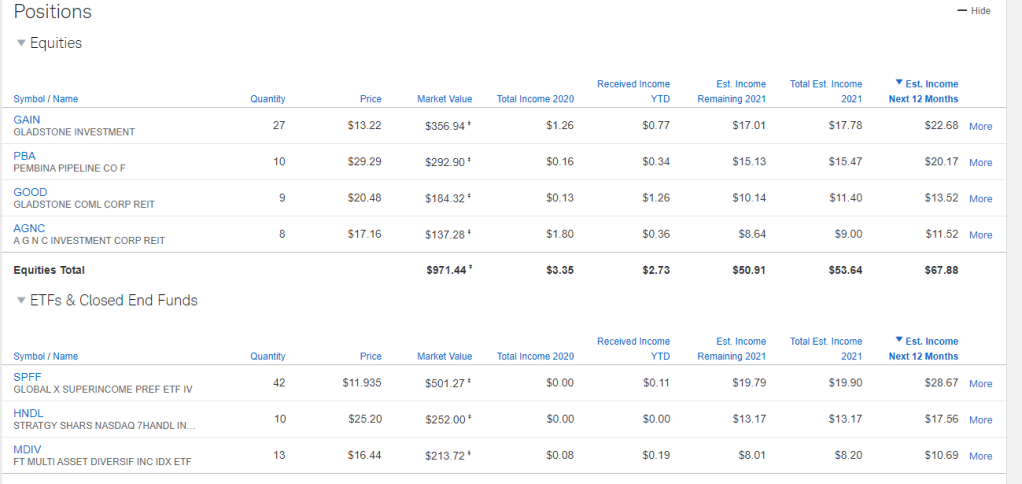

Due to the most recent events, I’ve reduced my portfolio to 11 stocks that pay monthly. My focus is going to at minimum be the total value per month equal to a living wage of the country, province, state, or city of which I want to live. I believe that this would allow me to at least get the option of what I would like to do for work, without having to worry about the basics.

| Monthly Stock Quantity Goal | |||||||

| Stock | Percent as a Number | Rule of 72 (2x) | Rule of 115 (3x) | QTY Total | Stock | Price | |

| AGNC | 8.81 | 8 | 13 | 21 | SPFF | $11.8978 | |

| GOOD | 7.67 | 9 | 15 | 24 | GAIN | $12.2700 | |

| PBA | 6.99 | 10 | 16 | 27 | MDIV | $16.2300 | |

| HNDL | 6.94 | 10 | 17 | 27 | AGNC | $17.0200 | |

| GAIN | 6.92 | 10 | 17 | 27 | GOOD | $19.7300 | |

| MAIN | 6.63 | 11 | 17 | 28 | HNDL | $24.7000 | |

| SPFF | 5.81 | 12 | 20 | 32 | SJR | $26.3900 | |

| MDIV | 5.48 | 13 | 21 | 34 | PBA | $28.8700 | |

| SJR | 5.00 | 14 | 23 | 37 | ANGL | $31.9000 | |

| ANGL | 4.67 | 15 | 25 | 40 | MAIN | $39.2600 | |

| O | 4.64 | 16 | 25 | 40 | O | $64.2200 | |

| TGIF | 2.51 | 29 | 46 | 75 | TGIF | $104.6107 | |

| Total | 72.07 | 159 | 254 | 413 | Total | $397.0985 | |

| Average | 6.01 | 13 | 21 | 34 | Average | $33.09 |

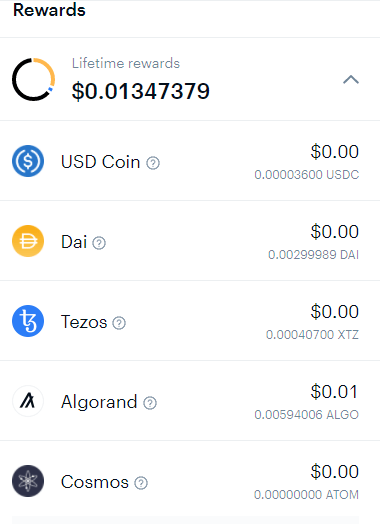

The table above shows what base quantity I will plan on starting each stock according to the percent as a whole number. The 72 column is the planned initial starting quantity and the 115 column is the planned bump up. Each stock I think will help to step up the dividends coming in added to interest earned and the portion of my paycheck going into the brokerage account. In addition to this, Coinbase offers some stable coins that earn “interest”, or rewards for holding them.

| Crypto Quantity | |||||||

| Date | 08-Apr-21 | ||||||

| Amount | Amount | $917.00 | |||||

| Crypto | Yield Percent (#) | 72 (2x) | 115 (3x) | Total | % Of Account | Crypto | % AMT |

| Algorand (ALGO) | 6.00 | 12 | 19 | 31 | 2.15% | ALGO | $19.72 |

| Cosmos(ATOM) | 5.00 | 14 | 23 | 37 | 2.58% | ATOM | $23.67 |

| Tezos (XTZ) | 4.63 | 16 | 25 | 40 | 2.79% | XTZ | $25.56 |

| Dai (DAI) | 2.00 | 36 | 58 | 94 | 6.45% | DAI | $59.17 |

| USD Coin (USDC) | 0.15 | 480 | 767 | 1,247 | 86.03% | USDC | $788.89 |

| Totals | 17.78 | 558 | 891 | 1449 |

In an attempt to copy and paste the excel sheet, I’m starting to realize it may have to be done different. If it makes sense, that would be good. If any clarity is needed, please let me know and I will be able to see if I need to go as far as starting the table from scratch to at least help with what’s being shown. I do plan on figuring out the best way to do my excel documents in the future.

As these two are just the first steps, I plan on expanding my investing portfolio as each becomes completed. Can only hope that it won’t take tooo long to build. As with all good things though, building a firm foundation helps to build the house of your dreams.

It was a pretty crazy day today for the stock market, dropping approx. 800 pts. When I woke up this morning, the only thing I had on my mind concerning the market was what I was going to buy from my list of stocks to add to my portfolio. After making sure that the portion of my paycheck I designate to my Schwab brokerage account, I bought 21 stocks under Schwab’s fractional share program called Schwab Stock Slices. For the stocks under the program, $5 is the minimum amount that can be used to buy into a stock.

The ticker symbols in bold are the stocks I have after today. Next week, four remain and the plan then becomes to buy 3 stocks per payday until the last payday in September.

Come October, I plan on checking the quantity of stocks that I per ticker symbol and sell the ones that are over their quantity number and put towards the ones that are still under. Once all the stocks that I have are at the baseline quantity I set for them, then I plan on buying the dividend baring stocks that aren’t part of the fractional share program and start the process again.

The income derived from the dividends will be added to the paycheck portion I have set going into the account, increasing what I can put towards buying stock and therefore increasing my dividend income.

The charitable account that I have will become a place where I will put at least 5% of any money recieved once I have reached a basic quantiy of all stocks I plan on buying though I have been reconsidering to when I start recieving dividends equaling $1+.

After spending a month in the Chicago and spending majority of my savings on hotels, food, and a little entertainment and not able to find a place to live in enough time while working for $13/hr, I have come back to the Seattle area. Renting a room and working saving for a place here. Initially want to at least have 3 months worth of current rent saved up in a savings account before considering the next step. Included with that as well will be 3 months of expenses, fixed and variable. Going to wait till October to see where that’s at, having 20% of my paycheck being sent to my Barclay’s savings account. Waiting till October should be able to allow it to build with the percent contribution plus the 1.15% interest.

In the meantime, I will add to my Schwab brokerage, especially now that they offer a form of fractional shares. How I found out it works is that $5 is the minimum to buy a slice of a particular company that is qualified for the fractional share program that they offer. Allowed is the ability to select up to 10 at a time, making the minimum $50, maxing out at about $7,000. Needless to say, I just have 10 stocks that I used $50 to buy. Once I buy all on the table that I set up to guide me, than create a share quantity baseline to help me have a goal and to start building my account by adding more like bonds, treasuries, and CD’s with Schwab and/or Capital One bank since that with Capital One’s CD’s don’t require a minimum and would make it easier to pay off my credit card when I use it.

Went for a walk today. Was odd seeing a way less busy area that would normally be swapped and swarming with cars, people, and transit vehicles.

A day like today, blue sky and a warming up, would definitely be a crowd of people just to even look around and maybe even get a bite in the area.

Hoping by the 30th of this month that the situation has calmed due to the necessary actions needed to be taken.

What I enjoy most about traveling is the change and newness of what comes along with it. I checked into the Quality Inn in the suburb Schaumburg. Very quiet per the usual, especially with it being in the immediate vicinity of a mall, Woodfield.

Weather today is warm, can tell it’s spring, bringing with it the promise of better times. Sitting a bit waiting to hear back about a couple jobs. Tomorrow will bring new prospects, in an effort to be in a new location.

| F | EXR | MSI |

| JWN | KO | LOW |

| XOM | EMR | EXPE |

| T | JNJ | MSFT |

| BA | BAC | AAPL |

| VZ | SBUX | NKE |

| ALK | KR | COST |

| UPS | HRL | GE |

| MMM | SCHW | |

| GPC | WMT |

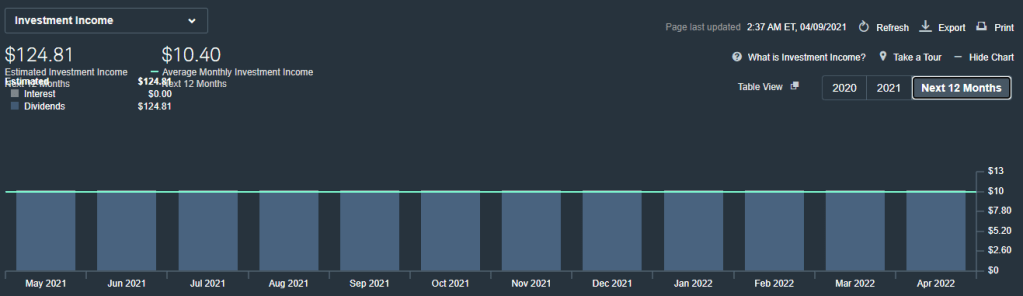

So far, I’ve combined a list of places I’ve worked with dividend paying stocks, businesses with HQ’s in the Pacific North-West, and suggestions by a youtuber Joseph Hogue. Since I couldn’t put more than 40 on each watchlist, I ended up making two and clicked on the header that made each list go according to price of each stock, low price to high price, then I printed. Opening a word document, I then proceeded to create categories of <$10, $10 – $50 , $50 – $100, and $100 – $1,000. With only a portion of my current paycheck going to the account I’d be making the transactions, this seemed like the best plan. In each price category, I’d use the higher end to determine how much I’d spend on buying stock. An example, in the $10 – $50 category, I used $50 as the amount I’d spend on each stock. So far, the range has been 1 quantity to 3 quantity. This has gotten me to about an average of $10/month currently, with the third month of each calendar quarter being the highest payout.

With Schwab currently being commission free, I’m able to buy a lot more than I used to, but quantity still be limited by the price. And with Schwab’s automated investment account, I can then then transfer the minimum amount required ($5,000) at the moment that it’s met, though I wish the minimum was slightly lower.

<$10

$10 – $50

$50 – $100

$100 – $1,000

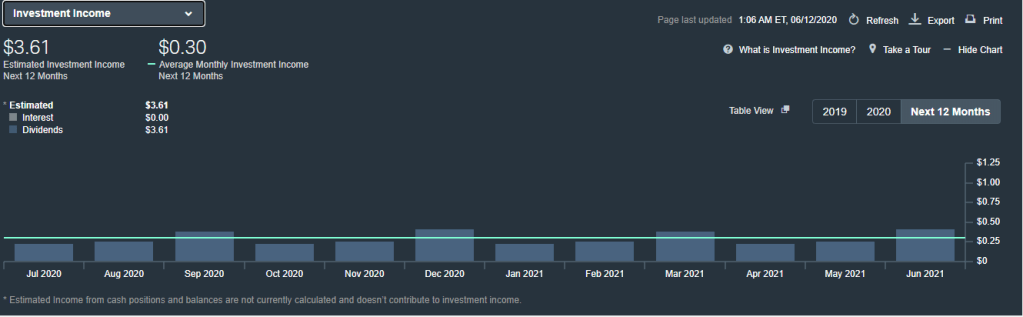

Figure 1 Current Income Level With Crossed Out Stocks

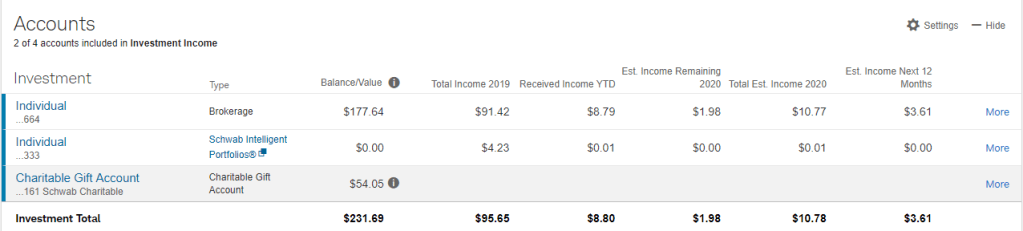

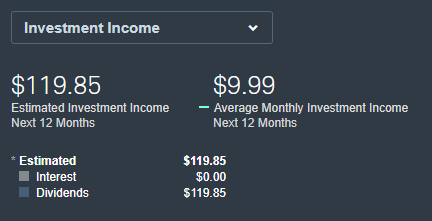

Figure 2 Current Level of Total Amount Invested.

In an effort to free myself financially, I have decided to try a few things. Legally of course. First step, use my brokerage account through Schwab since it’s my primary means of investing. I have considered using Robinhood or one of the many others, but I have been using Schwab way more frequently and figure it wouldn’t hurt.

The tickers I’m going to start with:

AGNC

MAIN

SBR

GAIN

LTC

BND

As it stands right now, I am going to start with $2104.16. Fee for buying stock is $4.95 and would bring the buying power to gain each stock to $345.74. With these being mostly monthly dividend paying stocks, it should allow additional buying power along with any interest gained from cash not used sitting in the personal brokerage account.

As soon as the markets open (9:30am EST/6:30am PST), the opportunity to buy will present itself. Living in the Seattle area currently, and if I want to be able to check on conditions when the markets open, I would have to be up and ready by 6:30am.

Most of what I want is to be able to have money to pay for basics along with being able to travel whenever I choose. Picked up a calendar that is themed with the 1,000 places to visit before you die. Figured it would be a good start for my traveling wants. Hopefully it won’t take too long to get to the point of being free and traveling the world, but being realistic does keep things in their place. Especially when the unexpected happens and may divert time and energy. Right now, things are looking smooth.

Hoping to be able to keep an update of efforts and travels.

Till we meet again.