I ended up missing my appointment for the passport with photo. Overslept and had to work. My last day of my current job is Saturday coming up and move to Chicago will be a month after at least, depending on living and work to get situated there.

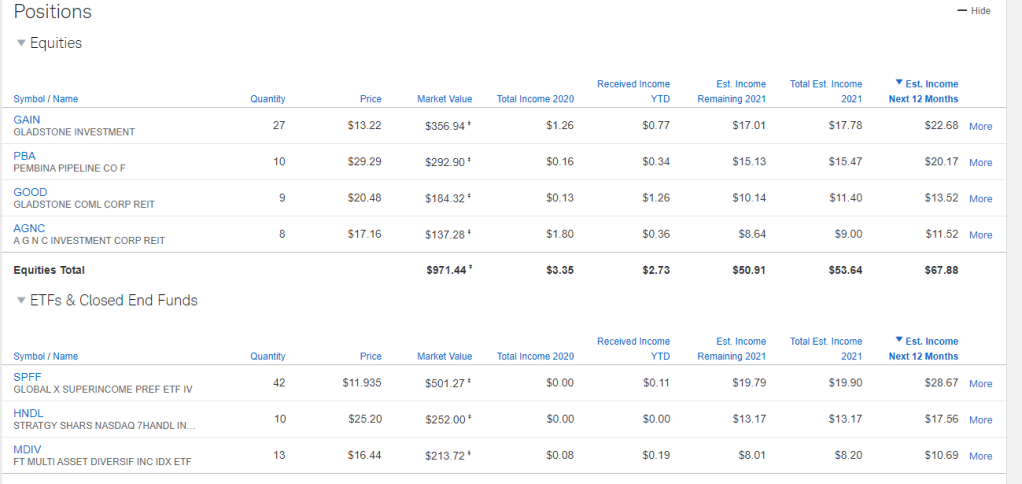

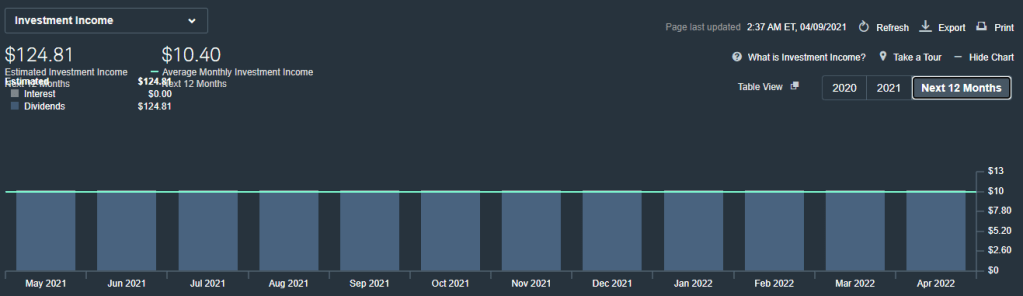

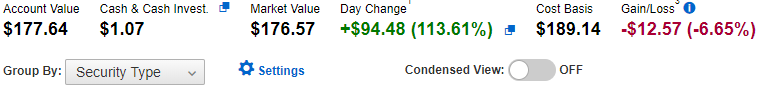

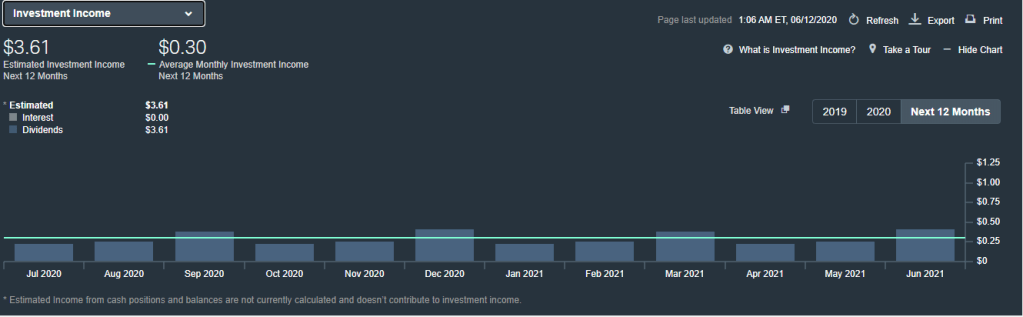

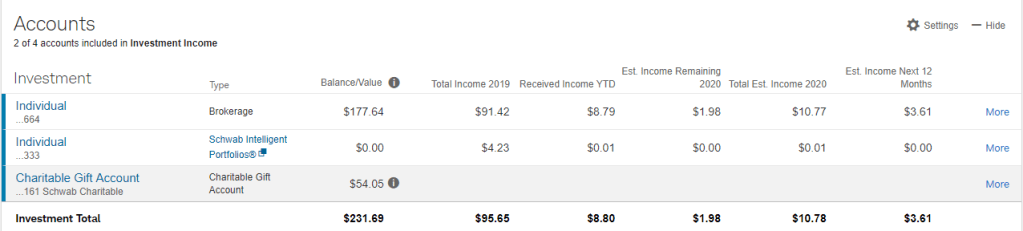

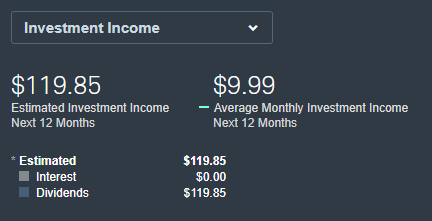

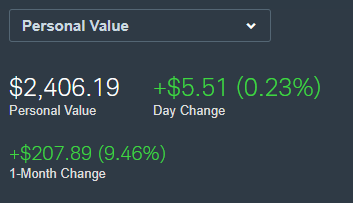

Ended up having to revamp my Robinhood account so that I can have the minimum at $1544 with dividend re-investment automated. Going to split it 54% stocks, 44% bonds (ETF: BND), 2% Cash. This hopefully gets me interest plus the DRIP, hopefully to increase at a desired rate during the six months before going Zambia. The six months will be for making my passport valid before traveling internationally.

My mom has cancer and has about 5 -6 months. I’m in a funk about it, depressed and hoping that it’ll be better than thought. The reality though is much different. For me, the move back to Chicago would be for a better job which would allow for a trip when the inevitable happens. The budget plan allows for trip and allowance when it happens.